The Rise of Passive Income with Cryptocurrency in 2024

In recent years, cryptocurrency has emerged as a revolutionary digital asset class, offering individuals the opportunity to earn passive income. With the ever-increasing popularity and adoption of cryptocurrencies, 2024 promises to be an exciting year for those seeking to capitalize on this trend. Passive income in the crypto market involves earning regular profits without actively participating in day-to-day trading. Whether you’re a seasoned investor or a newcomer to the world of cryptocurrencies, there are various strategies you can employ to earn passive income and make the most of this burgeoning industry.

Trends 2024

As of 2024, the cryptocurrency industry is evolving with several key trends shaping its landscape. Here’s an overview of the major trends and forecasts:

- Decentralized Platforms (DePin) and Decentralized Society (DeSoc) Expansion: Projects in the DePin and DeSoc categories are gaining traction, offering users enhanced control and monetization opportunities over their digital assets. This trend reflects the growing importance of decentralized solutions in the crypto space.

- Integration of AI and Cryptocurrency: The fusion of Artificial Intelligence and cryptocurrencies is a significant trend. This synergy, accelerated by technologies like OpenAI’s ChatGPT, is paving the way for advancements in trade automation, predictive analytics, and data management. It is also expected to contribute to enhanced transparency and security in the crypto ecosystem.

- Tokenization of Real-World Assets (RWAs): The process of bringing off-chain assets onto the blockchain is revolutionizing blockchain utility, enhancing transparency, and efficiency. This trend is seeing growing interest from institutional investors and is expected to gain further traction in 2024.

- Evolution of On-Chain Liquidity Models: Innovations like the Concentrated Liquidity Market Maker (CLMM) and Request for Quote (RFQ) systems are reshaping the market, addressing challenges such as impermanent loss. These developments signify the increasing sophistication of on-chain trading.

- Increased Institutional Adoption: The cryptocurrency market is seeing significant interest from large asset managers, indicating a strong belief in its long-term potential. This trend is further expected to be bolstered by the upcoming Bitcoin halving, which may attract even more institutional players.

- Enhanced Focus on Security: Security remains a critical concern in the crypto industry. Despite improvements in recent years, the industry continues to prioritize enhancing security measures to protect against exploits and other vulnerabilities.

- Account Abstraction and User-Friendly Wallets: There is a growing focus on making blockchain technology more accessible and inclusive, with developments in account abstraction and smart contract wallets. These advancements are expected to simplify on-chain activities and attract more users to the Web3 sector.

- Modularity in Blockchain Networks: The concept of modular blockchains is gaining prominence, with networks focusing on specific core components like data availability, consensus, and execution. While integrated chains like Solana maintain their importance, the trend is moving towards more differentiated chains, tailored by sector or function.

- Layer-2 Scaling and the Rise of Rollups: The growth of layer-2 scaling solutions is being driven by new rollup stacks and the abstraction of functionality into specialized layers, facilitating easier development of custom rollups. However, they are not significantly diverting activity away from the Ethereum mainnet but rather from alternative Layer 1 networks.

- The Long Road to De-Dollarization: The concept of de-dollarization continues to be a topic of discussion, with increasing trials in central bank digital currencies and bilateral agreements to reduce dependence on the USD. This shift may underscore the role of cryptocurrencies like Bitcoin as supranational assets.

These trends indicate a dynamic and rapidly evolving cryptocurrency industry, with innovations in blockchain technology, AI integration, and institutional involvement driving growth and diversification.

Top 10 Cryptocurrencies with the Highest Growth in 2023: A Portfolio Analysis of $100 Investments

| Rank | Cryptocurrency | Growth Percentage | Value of $100 Investment at Year End |

|---|---|---|---|

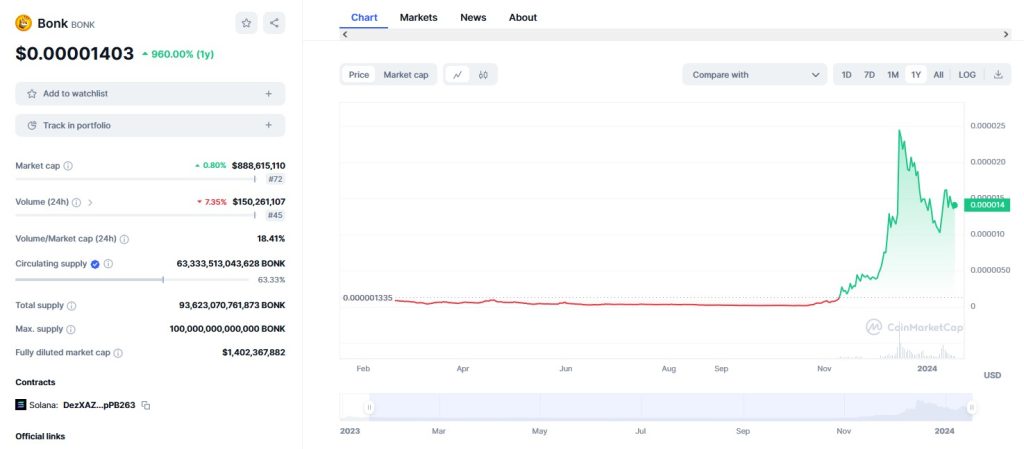

| 1 | Bonk | 7302.9% | $7,402.90 |

| 2 | Injective (INJ) | 2976.4% | $3,076.40 |

| 3 | CorgiAI | 1959.7% | $2,059.70 |

| 4 | Kaspa | 1865.6% | $1,965.60 |

| 5 | Render | 1139.0% | $1,239.00 |

| 6 | Solana (SOL) | 973.9% | $1,073.90 |

| 7 | Conflux | 773.6% | $873.60 |

| 8 | WEMIX | 758.7% | $858.70 |

| 9 | Fetch.ai | 697.9% | $797.90 |

| 10 | Stacks | 632.8% | $732.80 |

For comparison, Bitcoin (BTC) grew by 162.5%, turning a $100 investment into $262.50, and Ethereum (ETH) grew by 98.6%, turning a $100 investment into $198.60 by the end of 2023.

Exploring the Most Lucrative Opportunities in the Crypto Market

As the cryptocurrency market continues to evolve, new avenues for earning passive income have emerged. One such opportunity is staking, where you can lock up your cryptocurrencies in a wallet to support the network’s operations and earn rewards in return. Another avenue is liquidity provision, where you can provide liquidity to decentralized exchanges and earn a portion of the trading fees. Additionally, lending platforms allow you to lend your cryptocurrencies to other users and earn interest on your holdings. Exploring these lucrative opportunities can help you generate passive income while contributing to the growth of the crypto ecosystem.

Smart Strategies for Maximizing Your Passive Income Potential

To maximize your passive income potential in the crypto market, it’s crucial to employ smart strategies. Diversification is key, as investing in a range of cryptocurrencies can help mitigate risks and optimize returns. It’s also important to stay informed about market trends and news. Keeping up with the latest developments can help you identify new opportunities and make informed investment decisions. Finally, consider automating your passive income streams using platforms and tools specifically designed for this purpose. By leveraging automation, you can ensure a consistent stream of income without the need for constant monitoring.

Unveiling the Top Cryptocurrencies for Earning Passive Income

When it comes to earning passive income with cryptocurrencies, not all digital assets are created equal. Some cryptocurrencies offer higher yields and more stable returns than others. Among the top contenders is Ethereum, which allows users to earn passive income through staking. Another popular option is Binance Coin, which offers rewards for staking and participating in various activities on the Binance platform. Other notable cryptocurrencies for earning passive income include Cardano, Polkadot, and Tezos. Researching and understanding the potential of these cryptocurrencies can help you make informed investment decisions and maximize your passive income potential.

How to Safeguard Your Investments and Minimize Risks

While the potential for passive income with cryptocurrencies is enticing, it’s important to remember that the market can be volatile and unpredictable. To safeguard your investments and minimize risks, it’s crucial to employ proper risk management strategies. This includes setting realistic expectations, diversifying your portfolio, and using secure wallets and exchanges to store your digital assets. Additionally, staying informed about regulatory developments and potential scams can help you avoid unnecessary pitfalls. By taking these precautions, you can protect your investments and ensure long-term success in the world of passive income with cryptocurrency.

The Future of Passive Income with Cryptocurrency: Expert Insights

As we look to the future, experts in the cryptocurrency industry are optimistic about the potential of passive income. With technological advancements and increased adoption, the opportunities for earning passive income with cryptocurrencies are expected to expand further. Experts believe that the rise of decentralized finance (DeFi) will play a significant role in shaping the future of passive income. As more individuals embrace decentralized platforms and protocols, the potential to earn passive income through lending, liquidity provision, and other mechanisms will continue to grow. By staying informed and adapting to the evolving landscape, individuals can position themselves to benefit from the future of passive income with cryptocurrency.

In conclusion, earning passive income with cryptocurrency in 2024 presents a wealth of opportunities for investors. By exploring the most lucrative avenues, employing smart strategies, and understanding the potential of different cryptocurrencies, individuals can generate a consistent stream of income while contributing to the growth of the crypto market. However, it is essential to exercise caution and implement proper risk management strategies to safeguard investments. With the right approach and a forward-thinking mindset, individuals can position themselves to benefit from the future of passive income in the world of cryptocurrency.